Capital Raising Process

Capital Raising Process – An Overview

This article is intended to provide readers with a deeper understanding of how the

capital raising process works and happens in the industry today. For more

information on capital raising and different types of commitments made by the

underwriter, please see our underwriting overview.

Book Building Process

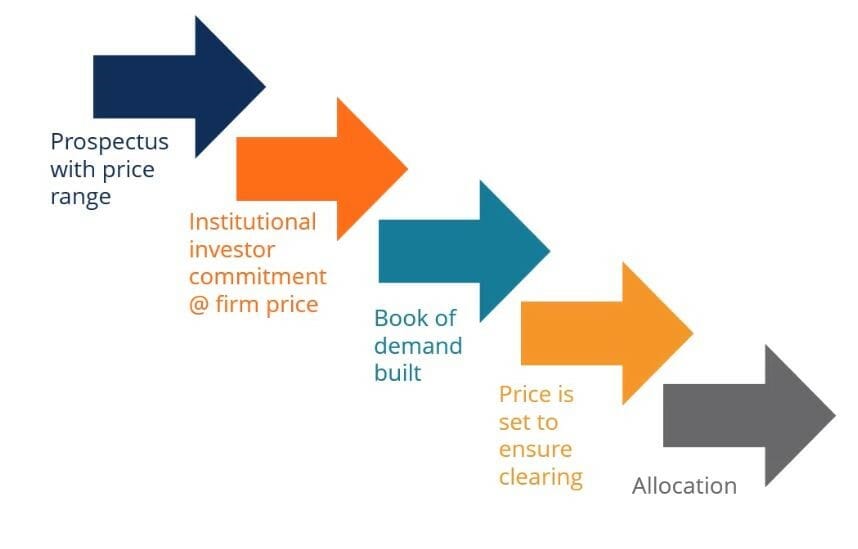

During the second phase of underwriting advisory services, investment bankers must

estimate the expected investor demand. This includes an evaluation of current

market conditions, investor appetite and experience, news flow, and

benchmark offerings. Based on all these conditions, investment bankers or

underwriters will draft a prospectus with a price range that they believe is

reflective of expected investor demand. Then, combined with institutional investors’

commitment, the underwriter will narrow the offering to a firmer price.

As investment bankers receive orders at certain prices from institutional investors,

they create a list of the orders, called the book of demand. From this list,

investment bankers will justify and set a clearing price to ensure the entire offering

is sold. Finally, the allocation of stocks or bonds will occur based on the subscription

of the offering. In the case of an oversubscribed book, some investors may not

receive the full requested order.

Roadshow for the Capital Raising Process

The roadshow is often included as a part of the capital raising process. This is when

the management of the company going public goes on the road with investment

bankers to meet institutional investors who are – hopefully – going to be investing

in their company. The roadshow is a great opportunity for management to convince

investors of the strength of their business during the capital raising process.

These are some critical factors for a successful roadshow:

1. Understanding the management structure, governance, and quality

Investors are adamant that management structure and governance must be

conducive in order to create profitable returns. For a successful roadshow,

management must convey efficient oversight controls that exhibit streamlined

business procedures and good governance.

2. Understanding key risks

Although risks aren’t positive, management must highlight and be upfront

about the risks involved. Failure to report any key risks will only portray their

inability to identify risks, hence demonstrating bad management. However,

management should emphasize their hedging and risk management controls

in place to address and mitigate the risks involved in carrying out their business.

3. Informing about tactical and long-term strategies

Informing investors about the management’s tactical and strategic plans is

crucial for investors to understand the company’s future growth trajectory.

Will management be able to create sustainable growth? What are the growth

strategies? Are they aggressive or conservative?

4. Identifying key competitors

Again, although competition isn’t a positive factor, management must clearly

address the issue with investors. When discussing key competitors, management

should lead the conversation to how their competitive advantage is, or will be,

more superior than that of their competitors.

5. Outlining the funding purpose and requirements

Why does the management need more cash? How, specifically, will the

money be used?

6. A thorough analysis of the industry/sector

Investors want to not only understand this company, but also the industry.

Is it an emerging market? What is this company’s projected growth compared

to that of the overall industry? Are the barriers to entry high or low?

Pricing

Even though investment bankers devote substantial amounts of thought and

time in pricing the issue, it is extremely challenging to predict the “right” price.

Here are some key issues to consider in pricing.

1. Price stability

After the offering is completed, investors do not want a lot of volatility.

High levels of volatility will represent that the security was valued incorrectly

or unreflective of the market’s demand or intrinsic value.

2. Buoyant aftermarket

If there is to be any price volatility after the issue, hopefully, it will be to the

upside. A strong post-issue performance indicates an underpriced offering.

3. Depth of investor base

If an offering attracts only a few highly concentrated investors, the probability

of price volatility will be high. The deeper the investor base, the larger the

investor pool, the more stable prices are likely to be.

4. Access to market

Pricing Tradeoff

Choosing the “right” price requires a tradeoff between achieving a strong

aftermarket price performance and underpricing. Therefore, an investment

banker should price the offering just low enough for a strong aftermarket

performance, but not so low that the issuer feels the offering is substantially

undervalued.

Costs of Underpricing

Underpricing an issue reduces the risk of an equity overhang and ensures a

buoyant aftermarket. Then why wouldn’t underwriters want to underprice

every time? In short, underpricing an offering is simply a transfer of surplus

from the issuer to investors. The issuer will incur an opportunity cost from

selling below its value, while investors will gain from buying an undervalued

offering. As banks are hired by the issuers, the underwriters must in good faith

make the best decisions and returns for the issuer by correctly balancing the

tradeoff.

IPO Pricing

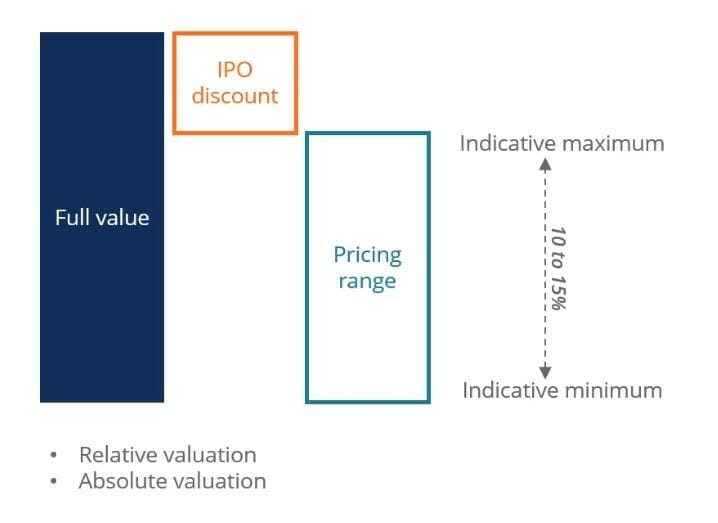

In order to price an IPO, banks must first determine the full value of the company.

Valuation is done by a combination of Discounted Cash Flow (DCF), comparable

companies, and precedent transactions analysis. For more information on business

valuation and financial modeling, please see our financial modeling guide and

Once investment bankers determine the value of the business through these

financial models, they deduct an IPO discount. Hence, in IPOs, there is usually

a discount on the intrinsic or full value of the business to price the offering.

The full value minus the IPO discount gives a price range that investment

bankers believe will attract institutional investors. Typically, 10%-15% is a

normal range for the discount.

However, exceptions always exist. In the case of a heavily oversubscribed offering,

the excess demand may offset the IPO discount. On the other hand, if the demand

is lower than expected, it may be re-priced below the expected price range.

Additional Resources

Thank you for reading CFI’s guide to the capital raising process. To learn more

about corporate finance, check out the following free CFI resources:

M&A Modeling Course

Learn how to model mergers and acquisitions in CFI’s M&A Modeling Course!

Build an M&A model from scratch the easy way with step-by-step instruction.

This course will teach you how to model synergies, accretion/dilution, pro forma

metrics and

a complete M&A model. View the course now!